Bridge Angel Investors are a group of passionate and committed investors who collaborate to fund local innovation. We qualify, fund, mentor and leverage our networks on behalf of our portfolio companies to provide a win-win opportunity for all.

Bridge Angel Investors (BAI) or BRIDGE was founded in 2017 to bring together resources, innovation, and dollars to growing enterprises (hence the acronym BRIDGE) in the Sarasota-Bradenton Area. We are an ever growing group of investor members in Sarasota with a focus on investing in early-stage companies based in Florida typically in syndication with other Florida-based angel investor groups. However, we broaden our reach throughout the US through trusted member and partner referrals. BRIDGE has joined forces with the Adi Dassler International Family Office (ADIFO) to invest in the leAD Sports & Health Tech Partners, the leading global sports and health tech investment ecosystem, inspired by Adi Dassler (founder of Adidas). Adi Dassler’s grandsons (Horst Bente and Klaus Bente) created leAD Sports, LTD (“leAD”) which consists of a group of shareholders dedicated to the acceleration of sports, health and fitness technologies for the benefit of entrepreneurs, clients of ADIFO, and ADIDAS. Bridge’s direct investment in leAD will facilitate access to a global network of investment opportunities.

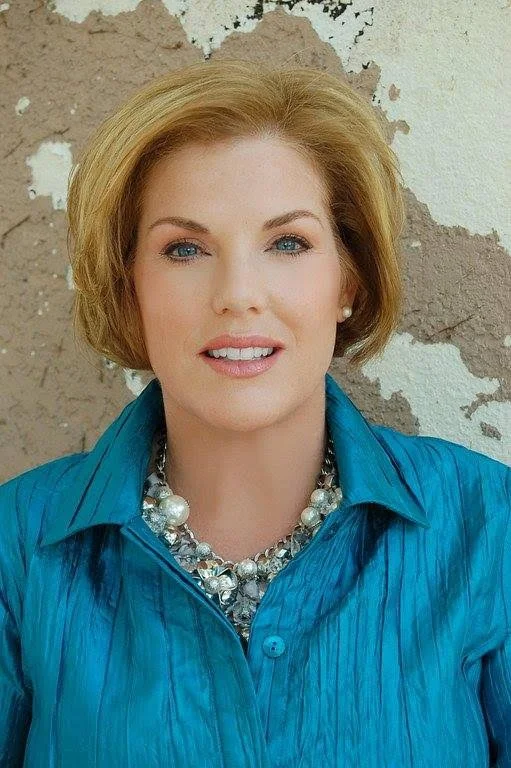

Executive Director

Kim Miele

Kim Miele is a lifelong connector. Bringing together people and ideas is her passion, whether through her myriad of roles as past Executive Director of the Gulf Coast CEO Forum, the planning of large-scale events for Harvard Medical School, or as a consultant for Startfast Venture Accelerator. She is a results-oriented, high-energy leader with experience developing and managing strategic partnerships, communications strategy, community relations initiatives, conferences, and special events. In her personal time, Kim is dedicated to putting her gift of connection to good use by serving the Sarasota/Bradenton communities.

Click on the image for a Linkedin Profile

Managing Team

Our Managing Team includes our Executive Director Kim and four managing members.

Click on the image for a Linkedin Profile

Paul Harder

● CEO, Owner, Founder with three successful exits in three different verticals.

● To Ford Motor Company after an 11-year CAGAR of over 20% in the automotive parts business.

● To Cott a public beverage company after an EBITDA growth from $28 to $84 million in four years.

·● PE with a software startup providing both a SAS option and full-service option to Healthcare Providers.

● Currently serving on private company boards and as advisor, mentor, coach and investor to both startups and fully operating companies.

Peter Offringa

● Technology leader specializing in building large-scale software infrastructure for major Internet companies

● Prior CTO/VP Engineering roles at CBS Interactive, CNET, Comcast, Zoosk, Boatsetter

● Currently serving in advisory board roles for local start-ups.

● Active blogger about software company investing.

Member Investors

Members of Bridge Angel Investors are a group of committed investors who help pick and fund portfolio companies, provide mentoring and leverage their networks to help portfolio companies be successful.

Click on the image for a Linkedin Profile

Patrick Del Medico

● 30+ years of documented success in sales, marketing, training, product development and performance management

● Executive leadership roles both nationally and internationally

● Strategic business planning for large Fortune 500 Companies ranging from Proctor & Gamble, Stryker Corporation and Baxter Healthcare to start-up entities to family-owned businesses.

● Executive Partner | COO for Florida Region, Shepherd Insurance

● Currently serves on the Board of Directors for the Gulf Coast CEO Forum as well as USF Risk Management & Insurance Industry Board and on the Advisory Board for Cardinal Mooney High School

William Foster

● Retired; Wells Fargo Securities 2016 as Senior VP of Investments

● During his tenure Wells Fargo acquired Wachovia, merged in Prudential Securities, and acquired Foster Brothers and Webber Co.

● As an active investor, owns various public stocks, privately held companies and operates four real-estate LLC’s that invest in commercial buildings in Northwest Ohio and Sarasota Florida.

● Currently serves on multiple boards in many different capacities (Chair, Committee Chair, Managing Member, Committee Member, Advisory)

Angela Grant

● Executive Vice President, Dealer Relations for PHD Entertainment

● Founder and President for SP Kids Distribution

● Medical Sales for Omnicare Pharmacies

● Registered Nurse

Justin Hertz

● Born and raised in Sarasota, FL

● Co-Founder, Owner and Operator of www.LiquidBottles.com or Liquid Bottles LLC

● Investor in Loaded Cannon Distillery in Lakewood Ranch

Scott Hearne

● Retired, Co-Founder of Longmeadow Holdings LLC. A multifamily development and real estate firm. Exited 2022.

● Co-Founder and CEO of engineering, development and construction firm located in the Denver Colorado area.

● Engineering Manager for a multinational engineering and construction firm (Bechtel Corp.) with regional and overseas assignments

James Keefe

● Broad executive experience across industries as diverse as biotechnology, investment management, academia, non-profit, as well as entertainment/media

● Ability to help entrepreneurs, business owners, and investors capture the power of strategic innovation driven by unique insights to push forward new ideas across a range of sectors

● International exposure (lived and traveled to over 86 countries) highlighted the importance of relationships and truly connecting with individuals, maintaining a curiosity and dream for something unique and different to help others in their journey.

Chip Moll

● Vice President, Corporate Development with MTD Products.

● Founded in 1932, MTD Products is a leader in outdoor power equipment headquartered near Cleveland, Ohio.

● Our engineering expertise and state-of-the-art facilities around the world fuel MTD’s reputation for innovation and award-winning products

Travis Priest

● Entrepreneur in Residence at Vocap Investment Partners

● Serial entrepreneur with 3 successful SaaS startup exits

● Consults with Angel through Series B funded SaaS startups; board member; advisor

Aaron Weikle

● Chief Executive Officer of ArganoMS3. Founded in 2009 MS3 provides high quality services to US Government agencies. MS3 helps the government transform business into a new era of enterprise using efficient computing and cost reductions through Open Source programs. We have supported a number of the largest government organizations over the past 7 years including entities like DISA, USCENTCOM and DoS.

● Senior SOA Lead and subject matter expert

● Senior Software Engineer and Applications Programmer

Chris Williams

● 25 year career in mergers & acquisitions industry for middle market private credit / private equity / investment banking

● Former Co-Founder & Managing Partner for two industry leading middle market private credit firms (Madison Capital Funding and Twin Brook Capital Partners)

● Prior roles included: credit / investment committee, group head for specialty industries, third party fundraising and daily management & operation of the firm(s)

● Currently active managing a family investment vehicle and investing in middle market private equity transactions

Interested in investing in early stage companies?

Learn more about becoming an angel investor with Bridge Angel Investors